Imagine managing a single pool of rewards points from your phone, redeemable throughout your day—on coffee, lunch, shopping, entertainment, and more—with just one effortless scan, eliminating the cumbersome ‘redeem-code-copy-paste-confirm’ routine.

Tokenization: Supercharging the Traditional Loyalty System

Smart Rewards, Real Value

This is the promise of tokenized loyalty: real, transferable tokens that work seamlessly across multiple brands, settling transactions in-store in under a second.

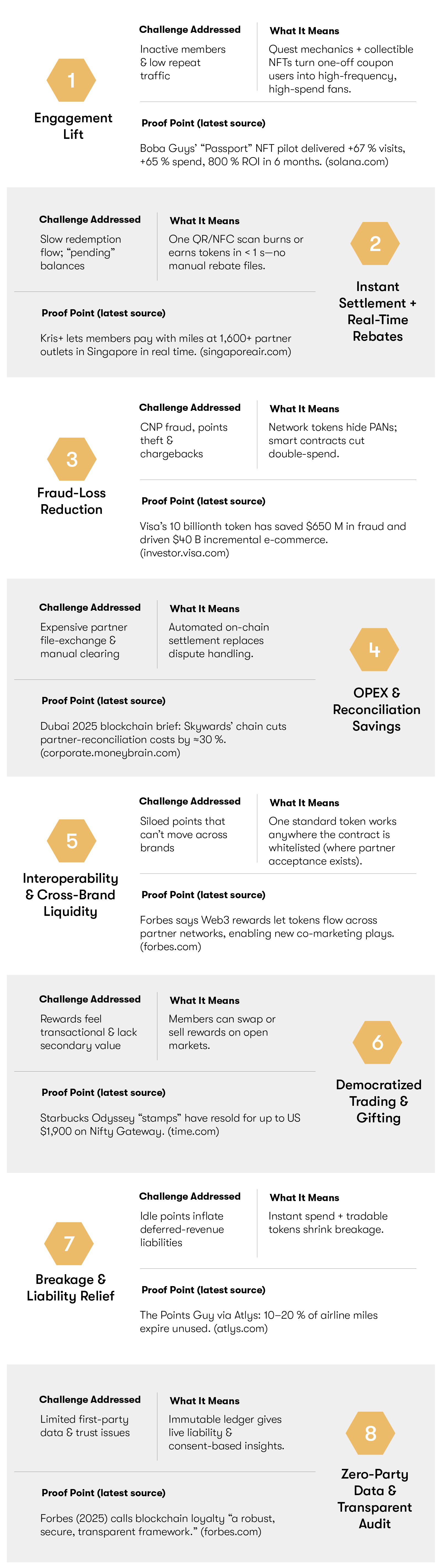

Loyalty tokenization involves replacing traditional loyalty systems with blockchain-powered platforms. This innovative approach addresses many of the challenges faced by traditional loyalty programs through its core benefit drivers:

Eight Key Benefits & Applications of Loyalty Tokenization

In practice, this tokenized loyalty system works by minting every point, mile, tier badge, or one-off perk as a cryptographic token on a blockchain, so that smart contracts, rather than batch files, issue, transfer, and burn rewards in real time. Because these assets live on-chain in a consumer-controlled (or custodial) wallet, they can flow across partner brands, trade on secondary markets, and carry verifiable scarcity, while the public ledger supplies an always-on audit trail — shrinking the chances of breakage and eliminating the fragmentation that plagues today’s closed, database-driven loyalty programs.

Traditional loyalty programs rely on merchant-owned databases—similar to local hard drives—where customer information, points, and rewards are stored and manually updated. Just as hard drives are being replaced by cloud computing, loyalty systems are now shifting toward more flexible, cloud-based models that offer seamless data access, greater scalability, and improved convenience for both businesses and customers.

A tokenized loyalty program also adds protections through “smart-contracts”, rules embedded in the tokens themselves, built for both the protection of the merchant and the customer. These protections include data privacy, prevention of double-spending of points, and elimination of manual reconciliation. Although Tokenization runs on “Zero-Knowledge Proofs” (verifying transactions without revealing personally identifiable information, an optional privacy add-on), it cannot guarantee protection for a tokenized loyalty program from misuse and fraud such as account takeover & phishing.

Tokenization can also be applied to payment & data security by replacing a card’s PAN (Primary Account Number) with an irreversible surrogate value stored in a secure vault. With this method, full functionality of the account is available with little to no risk of publicizing the PAN. Think of shopping online whereby Google allows you to save your actual card in their system and gives you a “virtual card” number to enter in online transactions. This way, the actual PAN of the card is not only hidden from view, but also unable to be deciphered from the virtual card number in case of a hack. This also allows card issuers to attach offers and real-time rewards to the card’s virtual account number “token” without any difference in usage functionality from the actual PAN (again, this is separate from blockchain-based point tokens).

Asset digitization is the goal of a tokenized loyalty program, creating a blockchain-based digital certificate that represents something of value. This digital certificate works very similar to how shares of stock are issued to represent the fractional value of a company: one out of 100 shares of a company’s stock, in someone’s hands, states that that person owns “1/100th” of the company “on contract”. The asset digitization aspect of tokenization creates this digitally represented stock certificate that can not only be redeemed like a traditional loyalty program but also traded or bought / sold like a traditional stock, thereby creating value beyond its initial face-value.

Tokenization, with its purpose of digitizing assets, exists in one of two forms: fungible and non-fungible. Let’s explore the differences:

Fungible Tokenization

The most common way to run a tokenized loyalty program is to make the loyalty points themselves fungible tokens—just like shares of stock we discussed earlier. In practice, this means every point is interchangeable and holds the same value as any other. This fungibility is the backbone of loyalty rewards, ensuring that each token is as good as any other when it comes time to redeem.

Non-Fungible Tokenization

Now here is where the fun begins: Non-fungible tokens (NFTs) are rewards that are completely unique and represent a value that is not explicitly quantifiable like fungible tokens (a point being equal to any other point). This unique value is determined solely by customers who define not only the NFT’s market worth but also its tradability, collectability, desirability, and other aspects of non-quantifiable value. Think of a special edition serialized Pokémon or Baseball card; such rarity creates a level of value far beyond its face value.

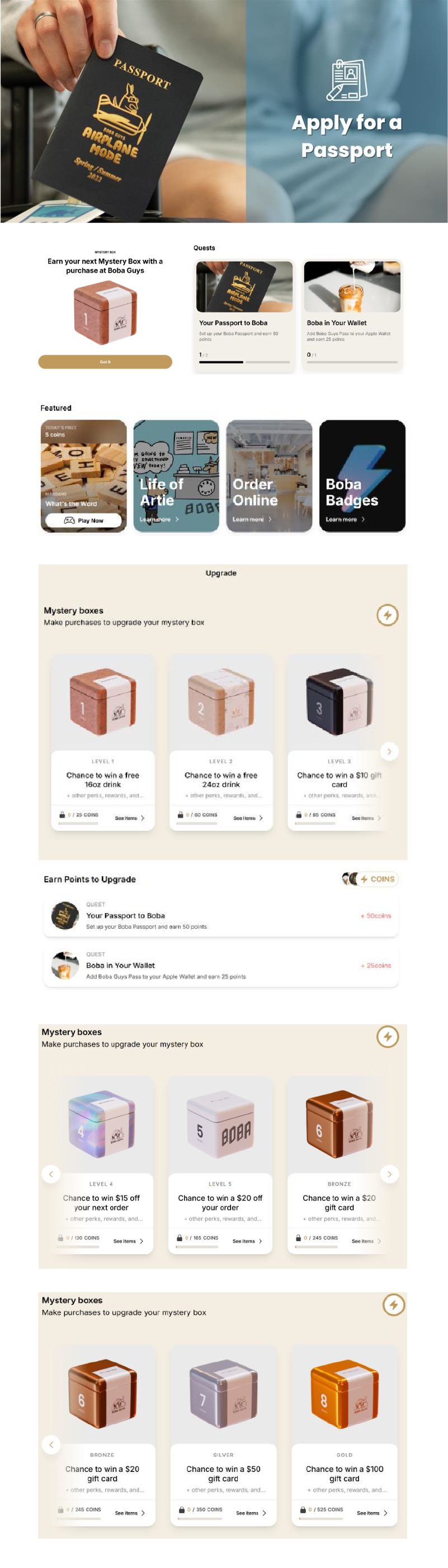

Industry Example (External): Boba Guys and Their Tokenized “Passport” Rewards

Source: Boba Guys | Image for representation only

Boba Guys built its brand on hand-stamped punch cards, back then a basic mobile stamp app, but co-founder Bin Chen soon judged “both glorified digital punch cards” that produced little insight or lift in repeat traffic. In June 2023 the chain partnered with Web3-loyalty start-up Hang to launch Passport, Boba Guys’ new tokenized loyalty program minting every drink purchase as an upgradeable “stamp NFT” on Solana’s high-speed blockchain; customers open a custodial wallet with one phone-number tap, while Solana’s sub-second, ultra-low-fee finality keeps café-counter queues moving. Because each stamp is on-chain, the rewards remain user-owned, tradable, and composable with other Solana-based programs—future-proofing cross-brand quests without new integrations.

Six months after launch, 15,000 shoppers had joined Passport and one Oakland flagship saw ≈70 % of all orders flow through the program. Pilot metrics were even sharper: +67 % monthly visit frequency, +65 % spend per member, and an 800 % ROI on program costs—numbers Chen unveiled at Solana Breakpoint 2023 and later confirmed in Foundation reporting. Gamified loot boxes, tiered “secret-menu” unlocks, and Apple-Wallet passes turned routine tea runs into quests, while every on-chain interaction supplied Boba Guys with zero-party data their old app could never capture.

For Boba Guys, tokenization replaced static stamps with programmable assets that customers truly own, tripling engagement and super-charging basket size—even as it lowered fraud risk, eliminated reconciliation work, and opened a path to future cross-retail collaborations on the same Solana rails.

Conclusion

Loyalty programs have come a long way from the traditional understanding and functionality of how rewards are earned and redeemed. The emergence of technologies such as tokenization, blockchain, web3, and more, represent a continued evolution of not just the concept of what a loyalty program should look like, but also its functional potential of going beyond just discounts and rewards. The future is ever-evolving, and will continue to produce innovations in the loyalty space that are centralized on one goal: forming deeper connections with our customers and making them feel part of the brand.

The views and opinions expressed in this blog are those of the author and do not necessarily reflect the official position or perspective of Photon.

References

- Case Study: How Boba Guys Revamped Its Rewards Program With Solana

- Singapore Airlines: Turn your purchases into flights

- Visa Issues 10 Billionth Token, Generating $40 Billion in Incremental E-commerce Globally

- Dubai Powered By Blockchain Strategy: Advancing the Blockchain Frontier

- The Web3 Revolution: How Blockchain Is Reshaping E-Commerce

- The Economics of Frequent Flyer Programs: How Airlines Monetize Loyalty

- The Trust Protocol: How Blockchain Is Redefining Security And Transparency In Business