Look around—digital transformation is occurring everywhere. In the past 4 years, the financial services industry has seen an unprecedented pace of innovation.

How banks are re-engineering the customer journey

Reinvent customer banking experiences to drive new growth

Photon leverages next-gen digital technologies to connect Fortune 100 banking and Finserve companies with their customers in the moments that matter and deliver digital banking experiences at scale.

Connect with Photon to keep up the pace in digital innovation which is simply going to continue accelerating.

- Comprehensive mobile banking UX

- Biometric mobile banking authentication

- Competitive branchless banking

- Social payments (P2P transfers and online purchases)

- NFC and RFID-based contactless payments

- Progress towards a cashless society through digital wallets

We see an even more disruptive time lying ahead as blockchain, IoT, and chatbots open the floodgates for the next big wave of innovation. Here are some highlights on where digital transformation is affecting the front lines in banking.

Big tech players are battling for leadership by aggressively investing in and opening their chat platforms to third-party developers. Amazon launched a Skills Kit for Alexa in mid-2015. In 2016 Apple announced SiriKit (Siri SDKs), Microsoft opened Cortana Skills Kit SDK, Facebook opened up its platform for Messenger chatbot developers, and more recently, we've seen the Google Assistant SDK. The timing couldn’t be better as there were concurrent breakthroughs in natural language processing and contextual understanding, crucial for chatbot success.

Even the largest, most conservative, and highly-regulated finserv companies are embracing next-gen chatbots to capture critical brand moments. Many are exploring proof-of-concept projects to integrate conversational interfaces in their digital strategy. For example, a leading Fortune 100 bank recently partnered with Photon to implement a chatbot to engage with customers in a personalized, contextual, and cost-efficient way.

“The best place to engage and delight customers is where they love to spend their digital lives—and right now, that’s on messaging platforms,” informs Srinivas Balasubramanian, CEO at Photon. We believe interfacing with the slew of new apps will become second nature and not need explicit actions, regardless of whether that conversation is the continuation of a chat with a bot, on Facebook Messenger, Whatsapp, on Amazon Echo or Google Home, or on the other extreme, a fully immersive Virtual Reality interface.

Consumers expect convenience and context. “We spend so much time in apps and online, we all know a great experience when we see one—when personalization and situational awareness create a dynamic sense of immediacy,” advises Jim Kim, AVP, Executive Creative Director at Photon. “The magic of mobile is the immediacy it delivers and is the lynchpin to a more personal, impactful customer journey,” he adds.

Finserv firms are focusing on digital technologies to earn customer confidence through consistent experiences. One such critical transformative technology is Application Programming Interfaces (APIs). Leading finserv enterprises are betting big on APIs to build out new functionalities faster and open up the digital ecosystems for innovation and better CX.

Leveraging Big Data analytics also becomes crucial as big data insights can enable better outcomes for not only front-end areas like marketing and customer service but also in risk management and regulatory compliance. For example, leveraging analytics, banks can better identify personalized engagement opportunities to upsell and increase customer lifetime value.

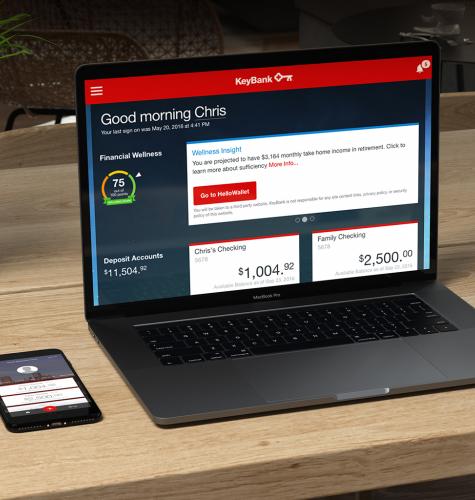

From building unified digital banking platforms to using adaptive/responsive design, HTML5, CSS3, and JavaScript to tackle endpoint diversity, finserv CIOs are focusing on digital best practices to win over customers with better experiences than those offered by traditional legacy banks. Proper execution on these multi-channel experiences builds the first level of trust with consumers and can be the first tipping point in the customer journey. A great example of one such industry-defining transformation is KeyBank’s transformation via core digital banking. Choosing Photon as its innovation partner, KeyBank “embarked on the digital modernization program to redefine convenience” according to Key Community Bank’s CIO Vipin Gupta.

Connect with Photon to keep up the pace in digital innovation which is simply going to continue accelerating.

A deeper look into banking transformation

Photon drives KeyBank’s transformation via digital core banking

Simplifying banking with an intuitive, easy-to-use interface

Building future-ready banks & reinventing FinServ with digital CX

Unlock new digital capabilities for FinServ and banking

Download CIO’s guide to security transformation